It’s hard to find a comparable energy company to Dong, the world’s largest developer and operator of offshore wind farms and European poster child for the transition from fossil fuels to green energy. Dong Energy is looking to sell a stake of approx. 17% which could value the company at €16bn.

Winds of Change: Move from black to green

Over decade ago, Dong Energy was one of Europe’s most coal-intensive utilities, providing thermal electricity to its customers.It was also very active in offshore oil and gas exploration and extraction in Norway and Scotland.

In recent years, the company embarked on an energy transition strategy and began selling off coal-fired assets and a part of its oil and gas business. For the past few years, their vision has been to reduce their energy generation from coal and transition to wind energy, becoming world’s biggest offshore wind company and are aiming to double their installed capacity from 3.0 gigawatts in 2016 to 6.5 gigawatts by 2020, equivalent to the annual electricity consumption of 16m people.

According to their March 2016 Investor Presentation, towards 2020, they expect to allocate 80% of their capital investment to wind, 10-15% to biomass conversation and investments into the power grid. Finally, an ever shrinking 5-10% is targeted towards oil and gas.

Chief Executive Officer Henrik Poulsen, had this to say regarding their transition, “Fundamentally it is a strong portfolio. However, we see simply better risk-return opportunities in the renewables business, and therefore we are managing the oil and gas business for cash and reallocating that cash back into renewables.”

However, there is no denying that Denmark today is still reliant on oil, coal and gas. Make no mistake, was it not for the North Sea oil fields, the Danish success story might have looked very different. Since the 1990s, the oil and gas driven from the seabed north of Denmark have made the Danes quasi-self-sufficient with oil and gas, while simultaneously boosting the Danish economy. But the Danish energy story is changing, the investment strategy clearly trends towards RE and away from fossil fuels.

Coming Soon: June 9th, 2016 Dong Energy IPO

On Thursday, 9th June, Dong will look to sell a stake of as much as 17.4% in an IPO that may value the company as high as 106.5 billion kroner (€16 billion) for 200 to 255 kroner (€26-34) per share, thus making this the largest IPO this year. Previously, Dong tried and stopped three past attempts to list from 2006 to 2008 due to market turmoil and other difficulties, but this time, they are marching ahead.

However, what’s special about Dong is that unlike any other large energy company, 75 % of its capital is already employed in wind power generation. While Dong has a small but active oil and gas business, it’s clear this is trending toward being a triviality in the overall core business mix.

Traditionally, investors interesting in exposure to RE through large companies typically have to invest in a traditional energy company whose diversification into clean energy is still small relative to their conventional power assets, but Dong has practically already transitioned. Moreover, the high quality domestic Danish power distribution network provides the stable revenue returns which are very reassuring to their investors. This signals that they can support investment in its core wind business.

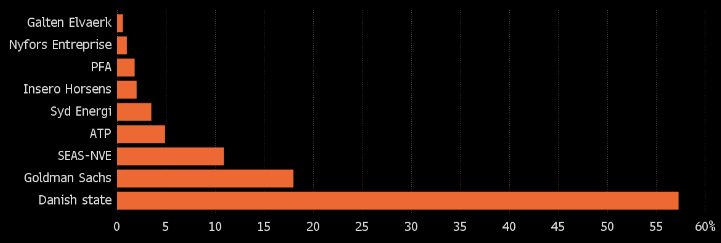

The Danish government now holds 59% of Dong and plans to maintain a holding of 51% after the IPO. Goldman Sachs with an 18% stake underscored its commitment to being a long-term partner in the future of the company.

Here are the take home messages that I think are valuable to keep in mind in the wake of their IPO:

1. Dong has access to very low-cost capital, especially in a macro backdrop where policy makers are incentivizing clean energy

2. Dong needs capital investment to ensure healthy returns to their shareholders

3. Dong’s objective, via this IPO is to share out the capital expenses through its partners

4. Dong’s distribution, generation and storage assets, can provide their grid resiliency in the cases of intermittency.