Moving into 2019, I will keep my eyes on the following issue:

- 🔋Batteries

Batteries are what will enable a sustainable energy future for us by tackling the ongoing problem of intermittency. Since solar and wind energy are intermittent 💡 (in a nutshell: if the sun stops shining because it’s cloudy, your solar panel stops producing electricity), they cannot be fully integrated into the baseload energy supply (powered by coal, gas, dams and other “reliable” sources). With batteries, you collect energy and store it for later use, the same way a water canister collects rainwater for later use.

Renewables – Storage = NOT A COMPLETE SOLUTION

Right now: the lights that are currently on in your house or office have been generated by electricity produced moments ago. This is how our gird works, supply must meet demand, and the electricity that is not used is wasted.

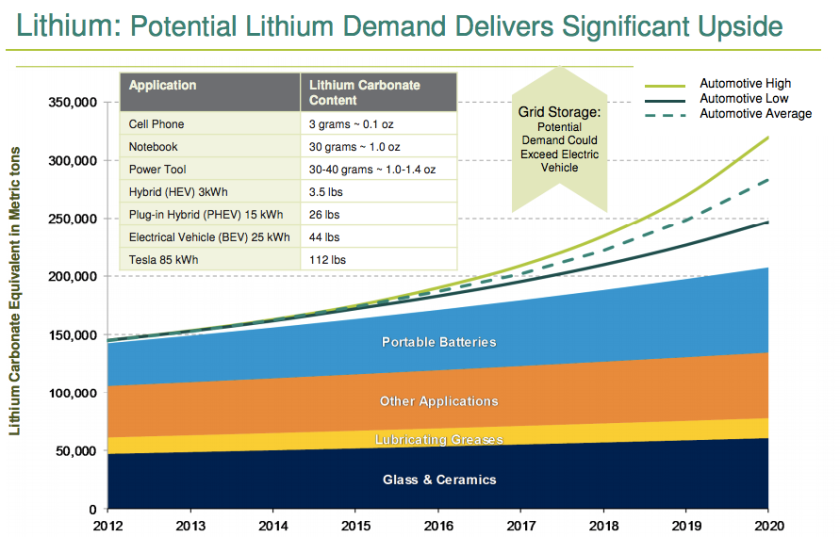

Currently, the best most extensively used technology we have got on the market is the lithium-ion battery. As the cost of production of these batteries continues to fall, Elon Musk (founder of Tesla) believes that lithium-ion battery costs will fall to $100/KWh by 2020, dropping from a price of $1,000 only as recently as 2010. Bloomberg forecasts battery storage costs to drop below $50 by 2030. As of today, the cost is in the $200 range. As the cost continues to drop, renewable energy sources will become increasingly cost competitive with conventional energy production. Moreover, the growth of electric vehicles (EV) is driving lithium-ion battery production. EVs currently make up only roughly 1% of all vehicles, but that will change rapidly. According to a McKinsey & Company, the EV segment of the light-duty vehicle market could reach 20% by 2030, pushing the need to develop, better and cheaper batteries further.

But lithium-ion batteries are not the only game in town. There are many companies operating in the in the hot sector, a notable one being Ambri, the liquid metal battery startup which spun out of MIT materials research, which received funding from the likes of Bill Gates. Other battery companies, in the last two years have for different reasons gone under, such as the Aquion saltwater battery, Alevo filing for bankruptcy, LightSail burning through its cash for its compressed air storage; ViZn Energy is on its last legs looking for new funding for its flow battery.

The challenge for the non-lithium ion startups lays in demonstrating that their battery is significantly less expensive than the lithium-ion one and can perform over a long lifetime with limited degradation. This is an enormously technically challenging for now.

2. Digitalization: Microgrids, Blockchain Technology, Data

Digitalization is an umbrella term thrown around by people in different sectors. In the context of energy, digitalization groups developing technologies such as microgrids*, Internet of Things (IoT), Big Data and Peer to Peer Technology, which improve efficiency and reduce costs.

This is a rapidly evolving area which is positioned to shift our energy system away from its centralized one-way street structure. It wants to shift our reliance on power stations and energy retailers, cutting out the middleman (and the associated cost) and moving us to more decentralized energy distribution.

⚡️Wholesale electricity distribution⚡️

Technology has the tendency to cut out the middleman , in this case, its the energy retailers. The end goal of blockchain and microgrids is to enable consumers to buy and trade directly from the grid, making traditional energy retailers unnecessary. The marketplace would be made up of consumers who buy and sell to each other based on their respective energy needs. This would significantly more cost-effective and energy efficient, because connecting local use and production with local grids, can allow us to achieve local balance.

I already can hear the, “But this would be terribly inconvenient! Wouldn’t buying electricity when you need it be totally impractical-besides how am I even supposed to know how much to buy and when?!“

Not at all. Not if we have an IoT (Internet of Things) device that automatically buys it for when you need it and how much you need. A device could be built into our homes, which would electricity when it’s cheapest at low demand, stores it in a battery, and then sells it back to the grid when energy is expensive at high demand.

In such a case blockchain technology would be the “middleman”.

Peer to Peer (P2P) Energy

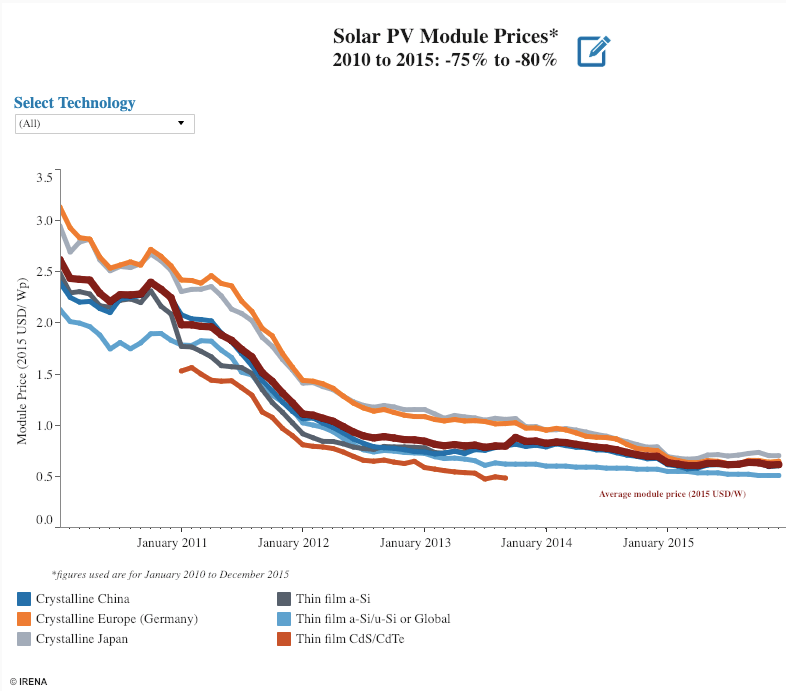

With the boom in solar panel installations and with the exponential decline in prices, we are not just energy consumers anymore — we are also the producers. If there are multiple people who produce energy in your neighbourhood, with their private solar panels, then you have a theoretical market place.

💡Case in point: I have solar panels on my roof to power my house. If I have leftover energy from my solar panels, it is sold back to the grid. Due to inefficiencies and high distribution costs in this process, I am not making much money.

With P2P energy, I could sell this leftover energy to my neighbour using blockchain technology. Because the blockchain acts as the middleman in this transaction, I would make more money selling it to my neighbour than I would selling it back to the grid. This is because:

- It’s cheaper for the neighbour to buy energy from me rather than our energy retailer. My neighbour can support renewables if they themselves do not have solar panels

- It’s a more eco-friendly and more efficient use of electricity as less energy is lost along during the transmission from power station to the house, since the electricity would be traveling from my house to the neighbours house

On a small and local scale, there are pioneering companies that are already doing this in the US and in Australia.

Right now, microgrids are an additional grid which operates in parallel with the current grid. But P2P blockchain companies anticipate this to evolve into larger, more distributed, interconnected microgrids.

📈Data is King

The energy sector collects enormous amounts of data on a continuous basis, thanks to the application of sensors, wireless transmission, network communication, and cloud technology. Data is being collected on both the supply and demand sides.

Data is only valuable if you know how to use it. The challenge rests in understanding how to harness this information in an efficient manner. But companies are starting to understand what this data can do for them and for the economy as a whole.

The only way to give this technology true value is to enable a statistical big data approach to it.

Intelligence comes from algorithms and self-learning, and from using data collected from sensors, databases, users, and meters.

As we gather and store information taken out of the energy system and smart meters, we can also compare that information to data that comes from weather patterns or consumer behavior.

By combining data streams, consumers and energy companies can be more efficient, make better use of their availability and aggregate capacity at the right time, in the right moment of the market, at the highest value, and create a better balance between demand and supply.

💡Case in Point: Devices in my house knows at what temperature I turn the heating on in my house, before I turn it on, and predict weather events, such as snowstorms which would trigger me to switch the heating on. The device would then, preemptively buy electricity at lower demand and store it in a battery for when the snowstorm arrives and the prices are higher.

Digitalization is already providing new opportunities for suppliers by optimizing their valuable assets, integrating renewable energies from different resources, and reducing operational costs; at the same time, it favors consumers by reducing the energy bills.

——

*If you are unfamiliar with microgrids and the implications that they will have (dare I say, are having) please check out my previous articles on the subject, The Energy Infrastructure That the U.S. Really Needs and🇺🇸Mr. Trump, Make The Grid Great Again!