I have heard it said:

“The [traditional] energy system employs millions of people!”

“Renewables will create massive job losses!”

“Fossil fuels may not be good for the planet, but at least they employ millions!”

and last but not least:

“Green jobs are the miracle that never happened”

Far be it for me to assess whether green jobs were ever meant to be “miraculous”, but I will say that “green jobs”, defined by the US Bureau of Labor Statistics (BLS) as either “jobs in business that produce goods and services that benefit the environment or conserve natural resources” or as “jobs in which workers’ duties involve making their company’s production process more environmentally friendly or use fewer natural resources”, are increasing at unprecedented levels.

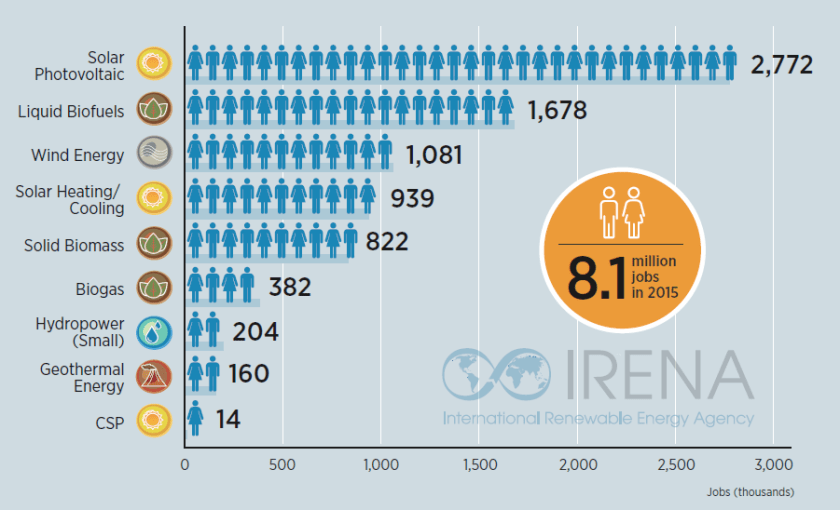

The International Renewable Energy Agency (IRENA) published their annual report detailing employment in the IRENA’s 2016 report, (link here – to learn more about their methodology, I suggest you check it out) estimated total employment in the RE sector to amount to 8.1m people. Adnan Amin, director-general or IRENA commented on the report stating, “The continued job growth in the renewable energy sector is significant because it is in contrast to trends across the energy sector. The increase is being driven by declining RE technology costs and enabling policy frameworks.”

Most of these jobs are in China, Brazil, USA, India, Japan, Germany, Indonesia, France, Bangladesh, and Colombia.

Jobs in renewable energy increased by 18% from the estimates reported two years ago with a steady regional shift towards Asia.

In 2014, the Solar PV emerged as the largest employer in the energy sector accounting for 2.8 million jobs, an 11% increase from last year, and two-thirds of which were in China. Solar PV grew the most in USA and Japan while decreasing in Europe. Indeed, the global aggregate production of solar panels keeps increasing and pushing further into Asia, with lower costs of installations driving that accelerated growth. Global wind employment crossed the 1m job mark, fueled mainly by deployment in China, Germany, the USA, and Brazil.

Although, it’s good news (mostly) all around, the winner this year is:

🇨🇳Gold Medal: China

China has firmed up to be the leading renewable energy job market in the world, with 3.5m people employed. Domestic deployment and rising solar PV demand solidified that growth at 4% to 1.4m jobs. Chinese Solar PV jobs are focused on manufacturing (with 80%) following by installations and operations. The largest solar water heating technology industry and market are in China since they provide for both domestic and international demand. Half of the global wind jobs are in China, and more than 70% of those are in manufacturing.

Moreover, China is also is a leader in hydropower employment, as they add 75 GW of new projects between 2014-2017. Construction and installation account for 70% of the countries large hydropower employment.

Indeed, China has and installed 65 gigawatts more in renewable energy in 2015, shift the labor force from oil and gas, towards renewables. Now, China employs 3.5m people in renewable energy and only 2.6m in oil and gas, that 35% more people in RE than in oil and gas (coal excluded).

Although the lion’s share of the RE labor force is employed in manufacturing, this growth rate is likely to begin to contract, in spite of growth in technological deployment due to:

- market consolidation in favor of large suppliers/ manufacturers resulting in economies of scale;

- automation of process will make manufacturing more efficient, which will make it less labor intensive.

The runner up is:

🇺🇸Silver Medal: United States

Renewable energy jobs in the USA have increased at a historic pace, owing to large consumer demand and constantly declining prices of RE, especially solar. The Solar Foundation’s National Solar Jobs Census 2016 found that the solar industry accounts for 2% of all jobs created in the US over the past year, with the absolute number of solar jobs increasing in 44 of the 50 states. As of November 2016, there were 260k solar workers employed in America, “representing a growth rate of 24.5% relative to November 2015” according to the report.

This is great news all round since it signals that solar is receiving investments and creating thousands of high-skilled jobs, ultimately driving growth, strengthening businesses and reducing emissions (pollution) in cities. Moreover, wind recovered from a policy-induced slump in new installations and saw wind jobs rise by 43%.

Moreover, according to the annual U.S Energy Employment Report, published January 2017, more people are employed in solar power last year than in coal, gas, and oil combined. They report found that 43% of the total electric power generation workforce was employed in solar energy while fossil fuels accounted for a mere 22%. The report goes on to say that the US solar installation sector alone employs more than the domestic coal industry. Since 2014, solar installation has created more jobs than oil and gas pipeline construction and crude petroleum and natural gas extraction combined.

The electricity mix in the USA is shifting decisively in the direction of renewable energy, driven by the transition from coal-fired power plants, to gas and now, steadily in low-carbon energy sources.

🇧🇷Bronze Medal: Brazil

Employment in RE in Brazil is concentrated in the cultivation and production of biofuels. I am aware that there is a huge debate regarding whether of not biofuels production (especially from sugarcane..etc) is considered a real “green job” but that is an argument for another day, but today, I will be counting them as green jobs.

With 821,000 jobs, Brazil continues to have the largest liquid biofuel workforce by far. Reductions of about 45,000 jobs in the country’s ethanol industry (due to the ongoing mechanization of sugarcane harvesting, even as production rose) were only partially offset by job growth in biodiesel. Biofuel production, especially in a developing country tends to be labor intensive, on account of inefficiency and poor access to technology, which have explained why those working in biofuels in Brazil are just under 1m people.

However, Brazils wind energy sector is growing rapidly, which power capacity expanding from 1 GW in 2010 to 6 GW in 2014. Moreover, while there was one mere wind power equipment manufacturer, there were ten in 2007, indicating the sector is maturing. Most of these jobs are in construction and manufacturing.

Brazil’s solar heating market is expanding strongly in the past decade. In 2013, there were an estimated 41k people employed, between manufacturing and installation.

🇪🇺Consolation prize: European Union

Owing to a mélange of adverse policy conditions, regulatory uncertainty and a sharp decrease in investment, the number of RE jobs in the EU declined from 1.25m to 1.2m. Germany, however, is the euro leader in terms of job, with 271k jobs in RE. This is more than double the runner-up, France, which is ahead of UK, Italy, and Spain. RE employment in France fell by 4%- primarily because solar PV installations dwindled by 45%). We are likely to see a shift, due to Denmark and the UK’s ambitious off-shore wind plans which will (if they go through with them) likely create expansion in the near future. The EU has been suffering consistent defeats against China in terms of lower manufacturing competitiveness and a weaker installations market, leading to a net decrease in solar jobs… for now.

“But Jobs!”

Growing awareness of the harmful effects of GHGs on the environment and on our health, coupled with consumer preferences are pushing investment into renewable energy, leading to logical increases in employment in RE. Conversely, the tumbling price of oil has led to a slowdown of industry expansion (too expensive deep off-shore, arctic projects, and unconventional drilling) and the corresponding reduction in capital expenditure and operational expenditure has had significant effects on the oil and gas labor force.

I do not think that the “But what about the jobs!” argument to be complete without merit. But a growing trend and body of evidence point to the fact that potential job losses in the traditional energy sector can be compensated by green jobs, however, an argument runs in parallel with this reasoning. And that is the fact that energy jobs are geographically and personally specific, meaning you can’t plug a worker out of an oil field in Texas and jettison them into a solar PV role easily. Re-skilling, training, and compensation for job losses are some of the conversations we will have to have in the next few years.

Nevertheless, the writing is on the wall.

Cover picture: Alex Wong, Getty Images