Following several rounds of consolidations by their competitors in the energy sector including General Electric’s purchase of Alstom’s energy business and a merger between Germany’s Nordex and Spanish rival Acciona Wind Power, Siemens and Gamesa have announced their merger.

Siemens and Spain’s Gamesa agreed last week to merge to create the world’s biggest manufacturer of wind farms, with the German company paying 1 billion euros ($1.13 billion) for a majority stake in the combined business. The combined group’s order portfolio would be worth some 20b euros. The merged business will have 21,000 employees, an installed power base of 69 gigawatts.

Before the merger

Before their merger, Siemens had an 8% share of the global wind turbine market, according to data from FTI Consulting, which made it the second-biggest manufacturer after Denmark’s Vestas, which had a share of nearly 12%.

But Gamesa’s relatively small 4.5% market share put it steadily behind other large players, such as China’s Goldwind, which has been growing internationally into fast-growing renewable energy markets in Latin America, as well as the parts of the US and Europe.

The Siemens-Gamesa merger

The Siemens-Gamesa merger would create a new global market leader in wind energy by capacity, surpassing China’s Goldwind, Denmark’s Vestas and General Electric, according to FTI Consulting.

The merger is broadly considered a win-win in that this move would bring together Siemens’ strength in offshore wind power in mature markets and Gamesa’s leading role in emerging markets.

Each has their own competitive advantage

More specifically, Siemens operates in the mature North American and European markets and whereas Gamesa’s turf are the fast-growing markets such as India, Mexico, and Brazil.

Moreover, Siemens’s wind division, which had almost €6 billion in revenue in 2015, manufactures and installs wind turbines for on- and offshore farms. But the business has been largely focused on the offshore market—where it has a large order backlog for turbines—while fumbling on onshore growth opportunities. Gamesa is also a major player across South America, where it expanded when the Spanish government cut subsidies to clean energy producers in 2013 as well as China and India, where it is the number one foreign producer.

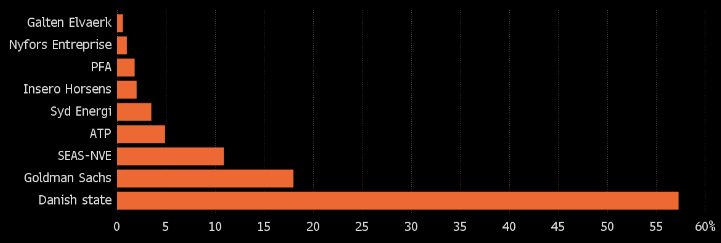

Siemens is known to all of us as a quality engineering company (whose other products include trains, medical body scanners, and technical instruments), but it has struggled to make its wind turbine business profitable. After the merger, it will take a 59 % stake in the company but it will not have a majority on the board but will have five out of the 13 board members in the new group.

Their deal states that in return for Siemens becoming majority shareholder, Siemens will pay Gamesa’s shareholders, which include Spanish utility firm Iberdrola, 1b euros in cash in the form of an extraordinary dividend.

The businesses will be combined within Gamesa which will retain its Madrid headquarters. The Spanish group is creating new shares to be offered to Siemens.

Gamesa has further affirmed that the merged business will be operational by March- April 2017 and will be worth 230m euros of earnings before interest and taxes (EBIT) within four years due to the cost and savings strategy that is being implemented. The idea is that getting bigger would also help to lower costs, one of the industry’s key targets in its race for more efficient turbines, which in turn will make it more competitive.